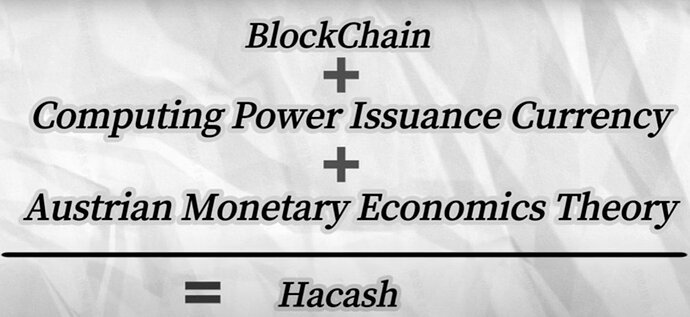

Why we use the term “money” instead of “cryptocurrency” for Hacash ![]()

In 1929, with the stock market crash on Wall Street, classical economists suffered from certain misconceptions such as the “Demand Deficiency Theory” and there were serious debates with Keynesian economists. During the 1973 Oil Crisis, Keynesian economists failed to predict stagflation, while supply-side economists predicted economic growth and consequent stability through tax cuts and deregulation. The 2008 Crisis and the Covid Pandemic crises similarly led to instability caused by the inflationary nature of fiat money.

Hacash aims to create a more stable and secure financial system by offering a series of measures and solutions to the root causes of global economic crises!

So what is the monetary theory on which Hacash is based? Is it the beginning of a global solution, a “money” that can be an alternative to fiat money?

Hacash not only solves blockchain problems, but also addresses the problems faced by traditional financial systems, such as inflation, trust, cost, speed and centralized control.

Hacash’s economic model has much in common with the principles of the Austrian School of Economics. Its decentralized structure, market demand-driven money supply, free market competition, inflation control, and minimal government intervention are all features that make it compatible with the principles of the Austrian School of Economics.

Hacash is also prudent against global crises. For example:

![]() The 1970s saw stagflation, a period of high inflation and low growth due to oil shocks and excessive money supply. Inflation negatively affected the overall health of the economy.

The 1970s saw stagflation, a period of high inflation and low growth due to oil shocks and excessive money supply. Inflation negatively affected the overall health of the economy.

Hacash’s Measure:

Hacash uses a mechanism that adjusts the money supply according to market demand and keeps inflation in check. A limited increase in the money supply within certain rules reduces the risk of inflation and ensures price stability.

![]() One of the causes of the 2008 financial crisis was that central banks over-expanded their monetary policy. This resulted in low interest rates and excessive credit expansion, followed by asset bubbles and economic collapse.

One of the causes of the 2008 financial crisis was that central banks over-expanded their monetary policy. This resulted in low interest rates and excessive credit expansion, followed by asset bubbles and economic collapse.

Hacash’s Measure:

Hacash controls the money supply within strict rules and algorithms. The production of new Hacash units is limited by a set supply limit and mining rewards. This prevents over-printing and inflation, and ensures that the money supply grows in a controlled manner.

Hacash offers a set of measures against the root causes of global economic crises. Features such as limited and controlled money supply, decentralization, inflation control, low-cost and fast transactions, Bitcoin transfers and block diamonds help Hacash create a more stable and secure financial system. These measures enable Hacash to provide an economic model that is resilient to the global crises of capitalism.

This is why Hacash fits the term “money”. Whether or not there is a future alternative to fiat money, this is the mission and vision of Hacash.

Source: hacash.org/whitepaper.pdf